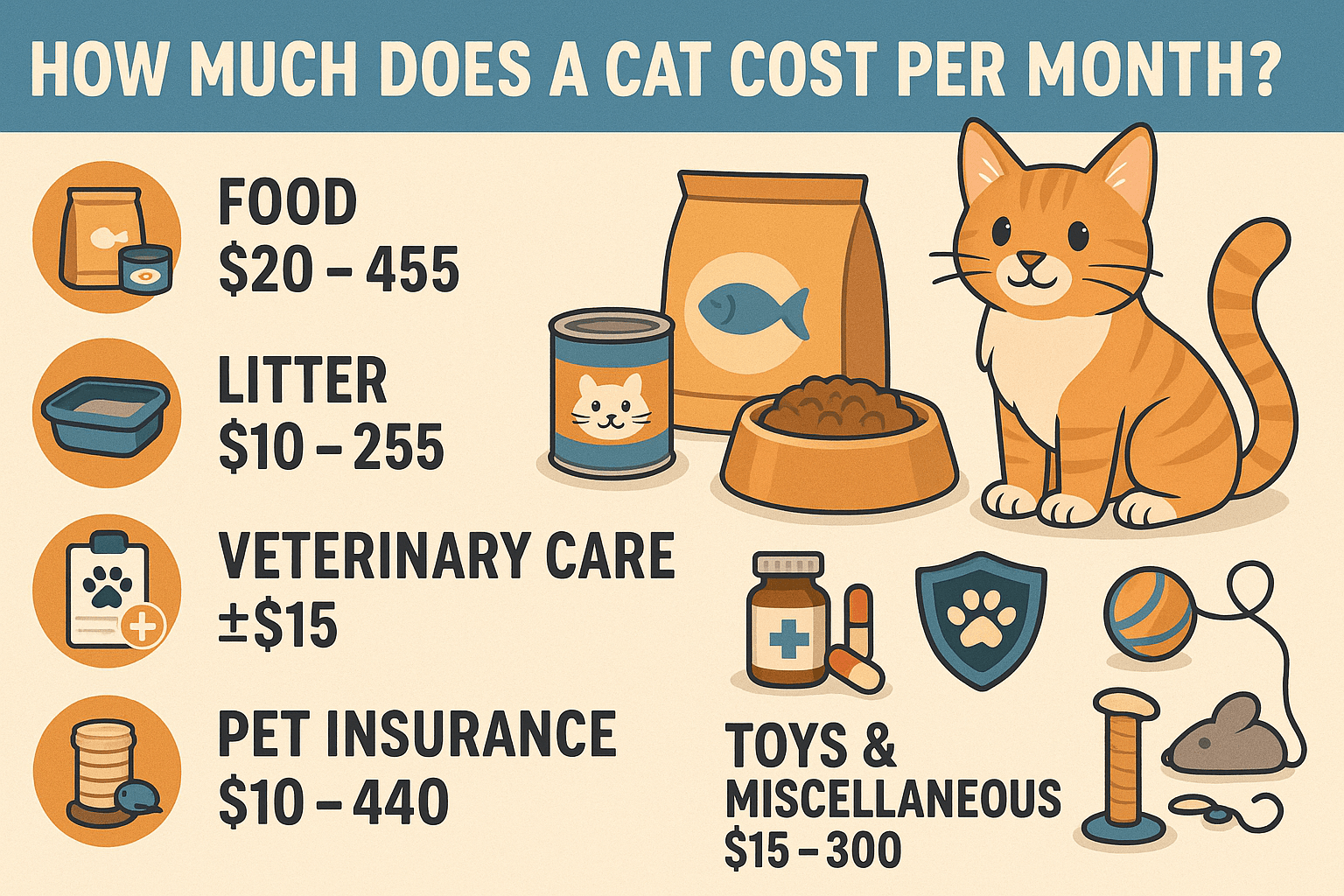

How Much Does a Cat Cost Per Month?

Bringing a cat into your home is not just about providing love and companionship—it also comes with financial responsibilities. From food and litter to veterinary care and toys, understanding the monthly costs of owning a cat is essential for ensuring you can provide for their needs without breaking the bank. Whether you’re considering adopting a feline friend or already have one, this guide will break down the expenses associated with cat ownership. Let’s explore what it takes to keep your furry companion happy, healthy, and thriving on a monthly budget.

Expert Insight: The True Cost of Owning a Kitten

“If your neighbor or friend’s cat has had a litter of kittens accidentally, they may be offering them as free to a good home. While this might seem like a bargain, remember that the cost of your kitten is a one-off expense and pales in comparison to the ongoing annual costs of keeping your new cat happy, healthy, and well-fed.”

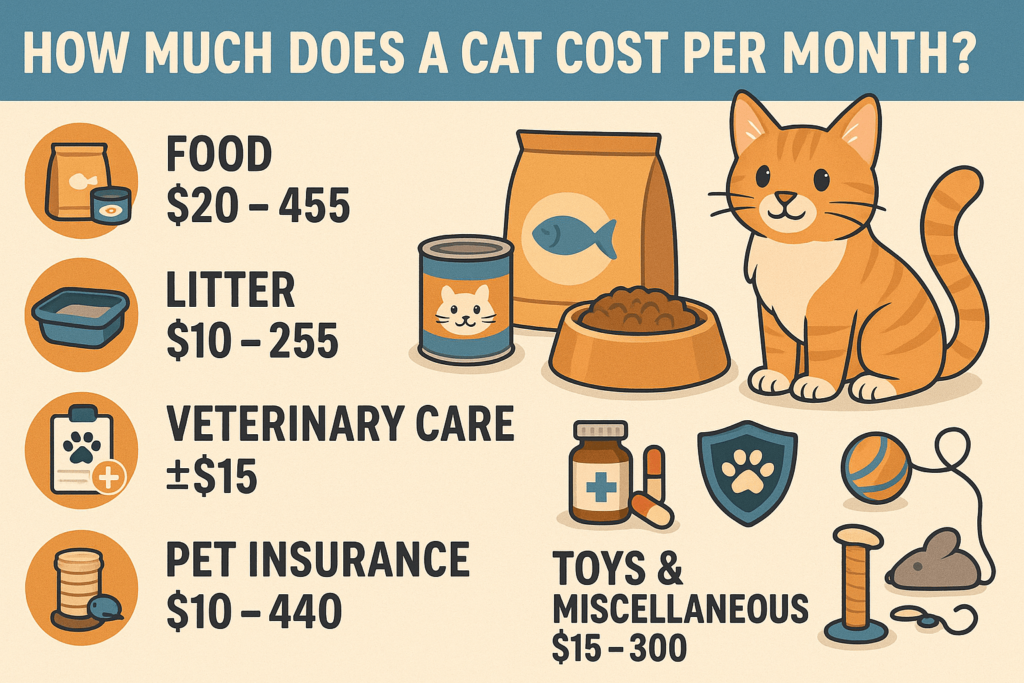

Essential Monthly Expenses for Your Cat

Caring for a cat involves several recurring costs that form the foundation of their well-being. These expenses are non-negotiable and ensure your cat stays healthy and comfortable.

Food and Treats:

High-quality cat food is a must, whether you choose dry kibble, wet food, or a combination. Budget approximately $20–$50 per month depending on your cat’s dietary needs.Litter Supplies:

Litter and litter box maintenance are ongoing costs. Expect to spend around $10–$30 monthly, depending on the type of litter and how often you replace it.Veterinary Care:

Routine check-ups, vaccinations, and flea/tick prevention add up to roughly $20–$50 per month, though emergencies may increase costs unexpectedly.Toys and Enrichment:

Cats need mental stimulation to stay happy. Allocate $10–$20 for toys, scratching posts, or puzzle feeders each month.Grooming Supplies:

Brushes, nail clippers, and other grooming tools may cost $5–$15 monthly if replaced periodically or used regularly.

These essential expenses form the backbone of responsible cat ownership, ensuring your pet has everything they need to thrive.

Optional Monthly Costs for Your Cat

While some expenses are optional, they can enhance your cat’s quality of life and strengthen your bond. Consider these additional costs based on your preferences and lifestyle.

Pet Insurance:

Monthly premiums for pet insurance range from $10–$50, depending on coverage levels. This can save money in case of unexpected vet bills.Luxury Beds or Furniture:

Investing in cozy beds, cat trees, or heated pads might set you back $10–$30 monthly if purchased regularly.Specialized Diets:

If your cat requires prescription food or specialty diets, expect to pay an extra $10–$40 beyond standard food costs.Training Classes or Behaviorists:

For cats with behavioral issues, professional help can cost $50–$100 per session, though this isn’t typically a monthly expense.Boarding or Pet Sitting:

Occasional boarding or hiring a pet sitter while traveling averages $20–$70 per day, which can translate to a monthly cost if frequent.

These optional expenses allow you to tailor your cat’s care to their unique needs, enhancing their comfort and happiness.

Check this guide 👉How Much Does Cat Food Cost Per Month? Best 7 Tips!

Check this guide 👉How Much Does a Rabies Shot for a Cat Cost? Best 7 Tips!

Check this guide 👉Understanding Cat Bloodwork Costs: Best 7 Health Tips!

Essential Monthly Costs | Approximate Monthly Range |

|---|---|

Food and treats | $20–$50 |

Litter supplies | $10–$30 |

Veterinary care | $20–$50 |

Toys and enrichment | $10–$20 |

Grooming supplies | $5–$15 |

Unexpected Costs That May Arise

While planning for regular expenses is important, unexpected costs can arise at any time. Being prepared for these scenarios ensures you’re ready to handle them without stress.

Medical Emergencies:

Accidents or sudden illnesses can lead to high vet bills, ranging from $100–$1,000+ depending on the severity.Dental Care:

Dental cleanings or treatments may be necessary every few years, costing $200–$500 per procedure.Home Repairs:

Cats can accidentally damage furniture, curtains, or electronics, leading to repair or replacement costs.Behavioral Issues:

Addressing problems like aggression or anxiety may require consultations with behaviorists, adding $50–$100 per session.Lost or Damaged Items:

Toys, collars, or carriers may need replacing due to wear and tear or loss, costing $10–$30 monthly.

By setting aside a small emergency fund, you can manage these unexpected expenses without compromising your cat’s care.

Ways to Save Money on Monthly Cat Expenses

Owning a cat doesn’t have to break the bank. With a little planning and creativity, you can reduce costs while still providing excellent care for your feline friend.

Buy in Bulk:

Purchasing food, litter, and treats in bulk often reduces costs significantly over time.DIY Toys and Enrichment:

Create toys from household items like cardboard boxes or fabric scraps instead of buying expensive alternatives.Regular Preventive Care:

Staying up-to-date with vaccinations and parasite prevention avoids costly medical issues down the line.Adopt Instead of Shop:

Adoption fees are far lower than purchasing a cat from a breeder, and many shelters include initial vet care in the fee.Use Coupons and Discounts:

Look for discounts at pet stores or online retailers to save on essentials like food and litter.

By implementing these strategies, you can stretch your budget further while ensuring your cat remains happy and healthy.

Factors That Influence Monthly Costs

Several factors can affect how much you spend on your cat each month, making it important to consider their individual needs.

Age of the Cat:

Kittens and senior cats often require more frequent vet visits and specialized diets, increasing monthly costs.Health Conditions:

Cats with chronic illnesses or allergies may need ongoing medications or treatments, adding to expenses.Size and Breed:

Larger breeds or long-haired cats may require more food, grooming, or specialized care, impacting your budget.Living Environment:

Indoor cats typically cost less than outdoor cats, as they’re less prone to injuries or exposure-related illnesses.Personal Preferences:

Owners who prioritize luxury items or premium services may spend more than those sticking to basics.

Understanding these factors helps you anticipate and adjust your monthly spending accordingly.

Benefits of Budgeting for Your Cat

Creating a budget for your cat’s care offers numerous advantages, ensuring both financial stability and peace of mind.

Avoids Financial Stress:

Knowing how much you’ll spend each month prevents last-minute scrambling during emergencies.Ensures Consistent Care:

A budget guarantees your cat receives all necessary essentials without cutting corners.Encourages Responsible Ownership:

Planning ahead demonstrates commitment to your cat’s well-being and long-term happiness.Allows for Savings:

Setting aside funds for unexpected costs ensures you’re always prepared for surprises.Promotes Bonding Time:

Investing in toys, activities, and enrichment strengthens your relationship with your cat.

Budgeting transforms cat ownership into a manageable and enjoyable experience for everyone involved.

Signs You’re Spending Too Much on Your Cat

While spoiling your cat is tempting, overspending can strain your finances unnecessarily. Watch for these signs that you might be going overboard.

Neglecting Other Financial Priorities:

If cat expenses interfere with paying bills or saving for emergencies, it’s time to reassess your spending.Buying Unnecessary Luxuries:

Expensive gadgets or designer accessories may not significantly improve your cat’s quality of life.Overfeeding Treats or Supplements:

Excessive treats or unneeded supplements can harm your cat’s health and waste money.Skipping Preventive Care:

Cutting corners on routine vet visits to afford luxuries can lead to costly problems later.Constantly Replacing Damaged Items:

Frequently buying new toys or furniture due to destruction suggests a need for better training or enrichment.

Recognizing these patterns helps you strike a balance between indulgence and practicality in your cat’s care.

Frequently Asked Questions About Cat Ownership Costs

What is the average monthly cost of owning a cat?

The average monthly cost ranges from $50–$150, depending on your cat’s needs and lifestyle.

Are there ways to cut down on vet bills?

Yes, pet insurance and preventive care can help reduce long-term veterinary expenses.

Do indoor cats cost less than outdoor cats?

Yes, indoor cats generally face fewer risks and injuries, lowering potential costs.

How much does it cost to adopt a cat?

Adoption fees typically range from $50–$150 and often include vaccinations and spaying/neutering.

Can I afford a cat on a tight budget?

Yes, by prioritizing essentials and finding affordable options, even those on a tight budget can care for a cat responsibly.

Planning for a Happy and Healthy Feline Friend

Owning a cat is a rewarding experience, but it requires careful financial planning to ensure you can meet their needs consistently. By understanding the essential and optional costs associated with cat ownership, preparing for unexpected expenses, and implementing cost-saving strategies, you can provide a loving and supportive environment for your pet. Remember, the joy and companionship a cat brings are priceless—but being financially prepared ensures both you and your feline friend enjoy a stress-free life together.

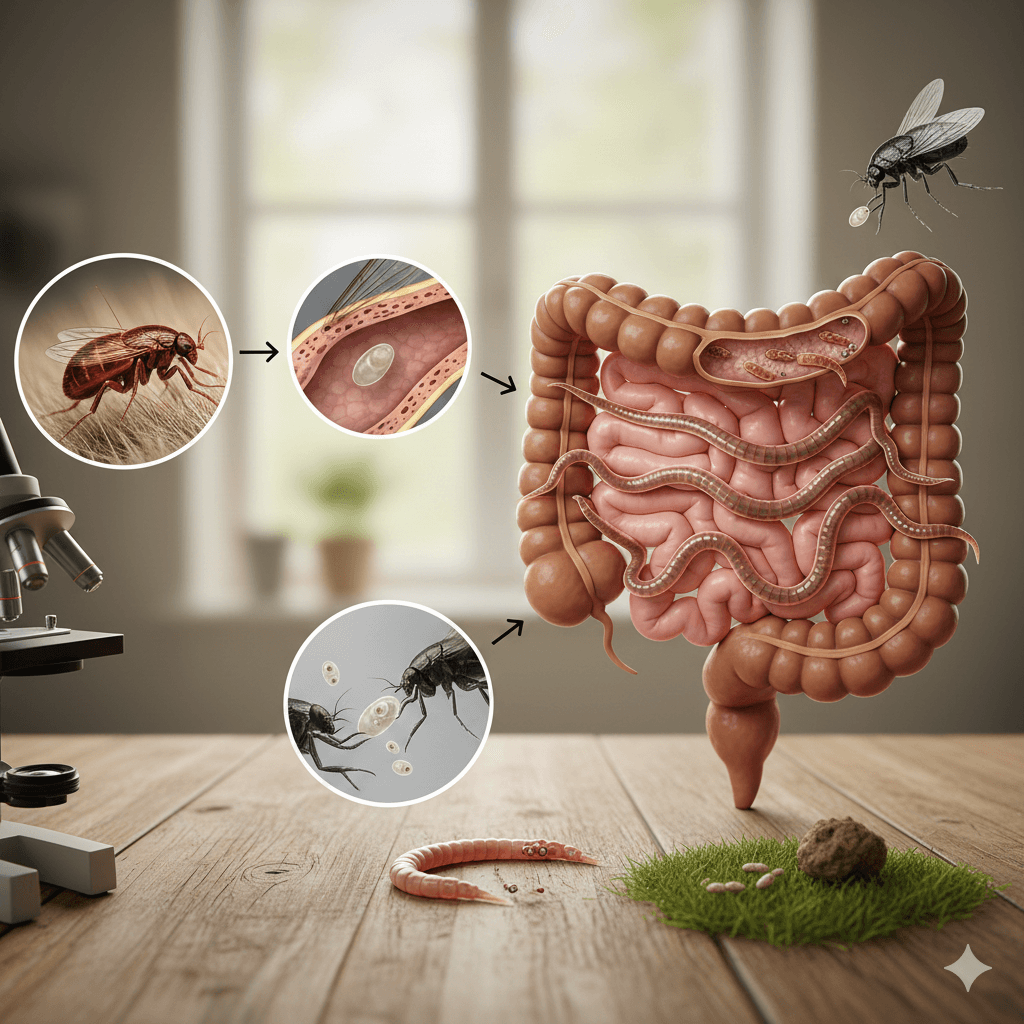

Dog Tapeworm Life Cycle: Best 7 Expert Tips! – Learn how tapeworms infect dogs, spot symptoms, and break the cycle with expert prevention strategies.

Anxious Cat Body Language: Best 7 Expert Tips! – Learn to spot signs of stress, understand triggers, and help your cat feel safe and relaxed.

Anxious Dog Body Language: Best 7 Expert Tips! – Learn to spot signs of anxiety, respond effectively, and help your dog feel safe and secure.

Is Breeding Dogs Bad? Best 7 Expert Tips! – Explore the ethics, benefits, and risks of dog breeding to make informed decisions for a better future.